Renters Insurance in and around Burton

Burton renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Trying to sift through savings options and deductibles on top of keeping up with friends, family events and your pickleball league, can be overwhelming. But your belongings in your rented townhome may need the terrific coverage that State Farm provides. So when mishaps occur, your sports equipment, furnishings and shoes have protection.

Burton renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Protect Your Home Sweet Rental Home

Renters insurance may seem like the last thing on your mind, and you're wondering if it can actually help protect your belongings. But imagine what it would cost to replace all the belongings in your rented home. State Farm's Renters insurance can help when fires or break-ins damage your valuables.

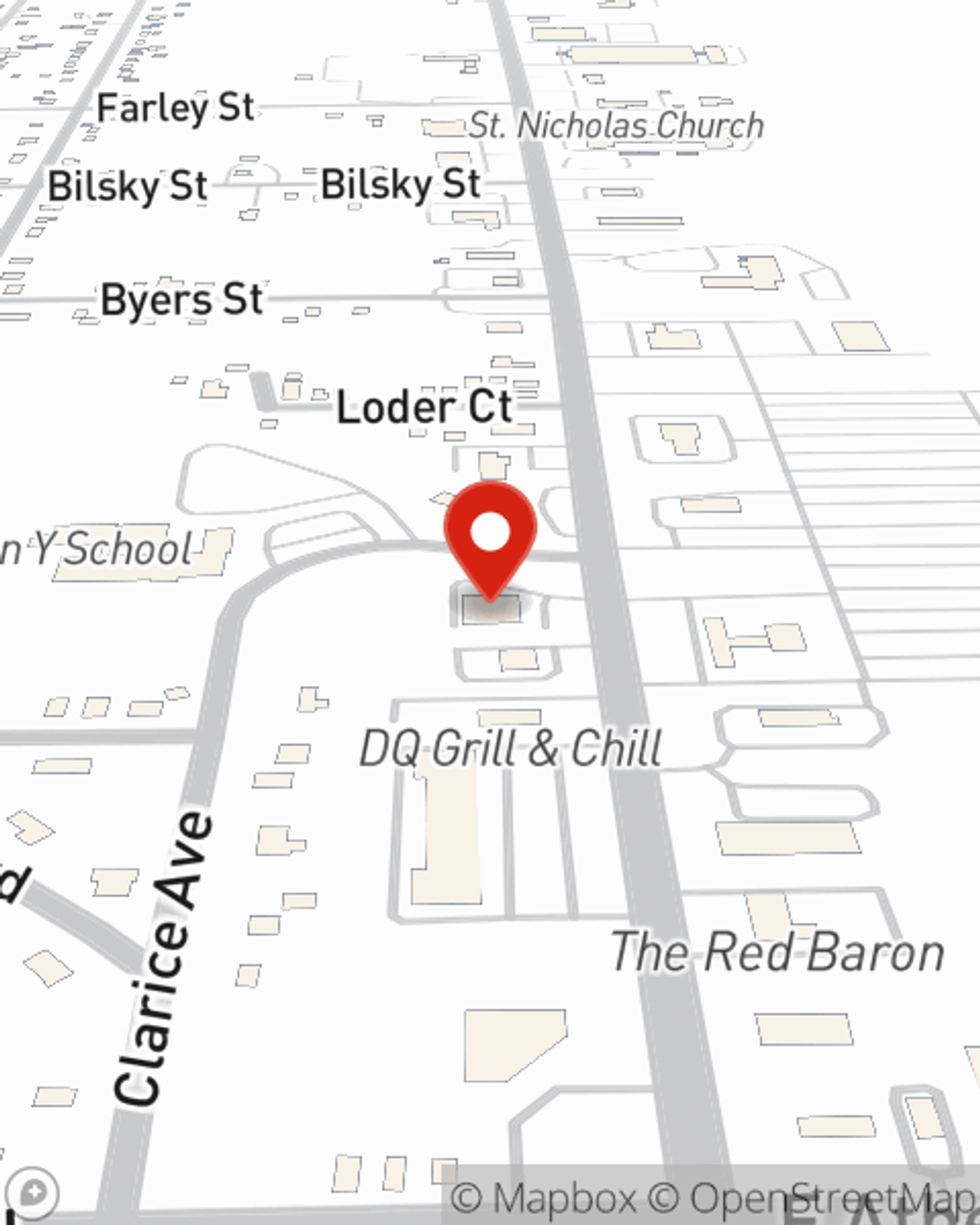

State Farm is a dependable provider of renters insurance in your neighborhood, Burton. Call or email agent Adrian Hunter today for a free quote on a renters policy!

Have More Questions About Renters Insurance?

Call Adrian at (810) 820-8552 or visit our FAQ page.

Simple Insights®

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.

Adrian Hunter

State Farm® Insurance AgentSimple Insights®

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Checklist for apartment renting

Checklist for apartment renting

When finding an apartment, it’s important to know what to look for so you can make a smart assessment about each property you’re interested in.